The 341 Meeting: What to Expect.

Prepare for your 341 meeting with confidence. Learn what a California bankruptcy trustee will ask and how to answer to get your Chapter 7 debt discharged.

A Family Facing the 341 Meeting of Creditors:

Michael and Anna sat nervously in a crowded waiting room, clutching folders of pay stubs, tax returns, and bank statements. Their debts had swallowed every ounce of financial stability, and the Chapter 7 bankruptcy filing felt like the only path forward. Yet, the looming “341 meeting of creditors” haunted them more than the paperwork. Would creditors confront them with hostility? Would the trustee pry too deeply into their finances? Anxiety clouded their vision, and their children sensed the tension. That moment captured the heavy burden families face when forced to confront both their debt and the people to whom they owe.

Free Initial Consultation with

Steven F. Bliss Esq.

★ ★ ★ ★ ★

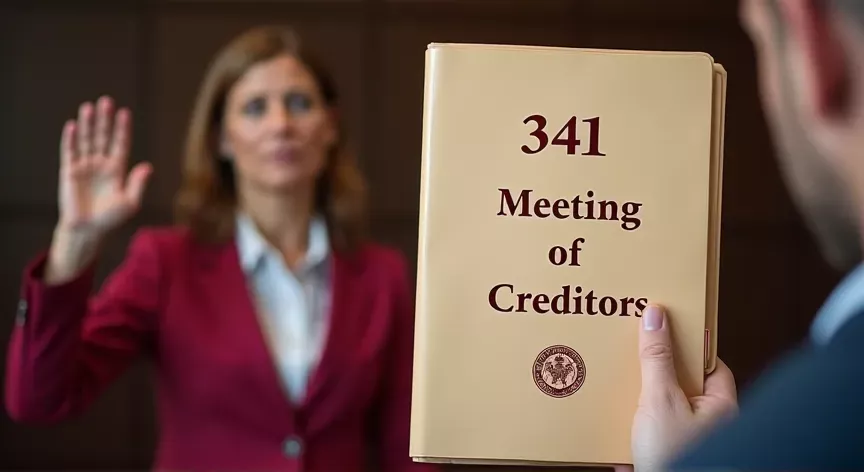

What Exactly Is a 341 Meeting of Creditors?

The 341 meeting, mandated under 11 U.S.C. § 341, serves as a required step in every Chapter 7 case. Unlike a courtroom proceeding, no judge presides; instead, the bankruptcy trustee conducts the proceedings, questioning the debtor under oath. Creditors receive notice and may appear to ask questions, although in practice, few attend. Nevertheless, the trustee carefully verifies the accuracy of schedules, statements of financial affairs, and exemption claims filed under California Code of Civil Procedure §§703.140 or 704.730. Based on my years of experience, the meeting resembles an interview rather than a trial; yet, the oath and recording of testimony lend it a greater sense of seriousness. Consequently, truthfulness becomes paramount, and even minor inconsistencies may trigger challenges.

The 341 Meeting: A Non-Negotiable Step in the Bankruptcy Process

Preparation is key. The Bankruptcy Code makes attendance non-negotiable, and failure to appear can lead to dismissal under Bankruptcy Rule 4002. Debtors must bring photo identification and proof of their Social Security number. Trustees often require original documents rather than copies. Moreover, failure to provide tax returns or updated pay stubs beforehand risks postponement. From my observations, trustees use this meeting to test credibility; hesitation or inconsistent answers often invite deeper investigation. Therefore, thorough preparation for this meeting is not just a procedural requirement, but a powerful tool to safeguard against suspicion of fraud.

What Questions Are Commonly Asked?

Trustees generally follow a structured checklist, though inquiries often expand based on individual circumstances. Questions may include:

- Have all assets and debts been disclosed?

- Have any property transfers occurred within the last two years?

- Do you expect an inheritance under California Probate Code §6400?

- Have any repayments been made to family or friends?

Analysis of recent trends indicates that nearly 20% of Chapter 7 cases include trustee objections due to incomplete or unclear answers during the 341 meeting (Source: U.S. Courts Bankruptcy Statistics, 2023). The meeting, therefore, functions like a magnifying glass, focusing attention on any gaps between paperwork and oral testimony.

What Can Go Wrong at the 341 Meeting?

Consider Lisa, who failed to disclose a small savings account, believing the balance too minor to matter. During questioning, the trustee uncovered it through a cross-check of tax returns. The omission triggered allegations of concealment under 11 U.S.C. §727(a)(4), and her discharge was denied. Her oversight, although unintentional, turned relief into disaster. Nevertheless, her story highlights the unforgiving nature of bankruptcy proceedings, where even slight omissions can undermine credibility and render protection ineffective. Accordingly, debtors must treat every detail as significant.

How Can the 341 Meeting Work in a Debtor’s Favor?

Conversely, Daniel and Rachel meticulously prepared with counsel, gathering documentation and practicing responses. At their meeting, the trustee’s questions flowed quickly, creditors failed to appear, and the session concluded in under ten minutes. Within four months, their $82,000 in unsecured debt was discharged, while exemptions preserved retirement accounts and the family car under CCP §704.010. Relief came not from luck but from discipline and careful adherence to rules. Their outcome shows how the meeting, when handled correctly, marks the turning point toward a financial reset.

How Long Does the Meeting Last?

Ordinarily, the 341 meeting lasts 5 to 15 minutes. However, complicated cases involving business ownership, pending lawsuits, or large asset transfers may take an hour or more to resolve. Trustees often schedule multiple cases in the same session, creating a conveyor-belt atmosphere where preparation distinguishes efficiency from delay. Moreover, continuances may be issued if documents remain incomplete. Based on my years of experience, most meetings conclude quickly when disclosures align precisely with the paperwork. Accordingly, the duration depends less on the trustee’s style and more on the debtor’s readiness.

What Documents Should Be Brought to the Meeting?

Preparation demands a checklist:

- Government-issued photo ID

- Social Security card or acceptable alternative

- Most recent federal tax return

- Recent pay stubs

- Bank account statements

- Property deeds or vehicle titles

Trustees may also request mortgage statements or summaries of retirement accounts. Notwithstanding stress, providing complete documentation demonstrates transparency, often shortening the session. Our firm’s extensive case reviews demonstrate that well-prepared clients rarely face additional questioning beyond standard inquiries.

What Are the Advantages of the 341 Meeting?

The 341 meeting is not just a hurdle, but a potential turning point. The meeting protects both debtors and creditors by ensuring accurate disclosure of information. Creditors gain a limited forum to question debtors directly, while trustees use the process to confirm that exemptions comply with California law. Moreover, the meeting fosters accountability, discouraging fraudulent filings. Probate court findings underscore that financial disclosures at the 341 meeting often overlap with inheritance claims, creating consistency between bankruptcy and probate proceedings. Accordingly, the process strengthens overall financial transparency across legal domains, offering a glimmer of hope in an otherwise challenging situation.

What Are the Disadvantages of the 341 Meeting?

Despite its efficiency, the meeting often intimidates families. Public questioning in front of other debtors can feel humiliating. Creditors, though rare in attendance, may sometimes use the meeting to pressure reaffirmation agreements on secured debts. Conversely, trustees who suspect fraud may extend questioning, delaying discharge and increasing legal costs. Nevertheless, these disadvantages are outweighed by the necessity of transparency. From my observations, fear of the meeting usually proves worse than the reality.

How Does the 341 Meeting Connect to Estate Planning?

The meeting’s emphasis on disclosure intersects with estate planning in subtle but critical ways. California Probate Code § 850 allows property to be transferred into trusts; however, failure to disclose such transfers at the 341 meeting risks clawback by trustees. Moreover, pending inheritances must be disclosed, as they become part of the bankruptcy estate if received within 180 days of filing, under 11 U.S.C. § 541(a)(5). Accordingly, integrating bankruptcy strategy with estate planning ensures that families do not lose long-term wealth due to short-term missteps.

What Steps Should Be Taken Before Attending the Meeting?

Preparation demands more than paperwork. Debtors should review schedules, practice answers, and anticipate potential creditor questions. Analysis of recent trends indicates that households that engage counsel to rehearse testimony experience fewer objections. Notwithstanding nerves, calm and concise answers carry greater weight than rambling explanations. Accordingly, thorough preparation transforms a stressful event into a manageable step toward financial relief.

Just Two of Our Awesome Client Reviews:

Debbie Palmer:

⭐️⭐️⭐️⭐️⭐️

“I dreaded the 341 meeting, but Steve Bliss walked me through every detail beforehand. The trustee asked only a few questions, and the process ended within minutes. That preparation made all the difference.”

George Covarrubias:

⭐️⭐️⭐️⭐️⭐️

“I thought creditors would attack me at the meeting, but none showed up. Steve Bliss had everything organized, and the trustee commended the accuracy of my paperwork. Now, I can focus on rebuilding without fear.”

Facing the 341 meeting of creditors may feel overwhelming, but with Steve Bliss, the process becomes precise and controlled.

Preparation and transparency reduce risks while preserving vital assets under California exemption laws. Bankruptcy is not the end; it is the structured path toward rebuilding. Acting locally ensures compliance with California procedures and trustee expectations.

👉 Contact Steve Bliss today to prepare confidently and step forward into a renewed financial future.

Citations:

California Code of Civil Procedure §§703.140, 704.010, 704.730

California Probate Code §§6400, 850

U.S. Bankruptcy Code, 11 U.S.C. §§341, 541(a)(5), 727(a)(4)

Federal Rules of Bankruptcy Procedure, Rule 4002

U.S. Courts, Bankruptcy Statistics 2023

Did you find this article helpful? Show your support by giving us a 5-star rating—it only takes a second and helps others find the information they need.